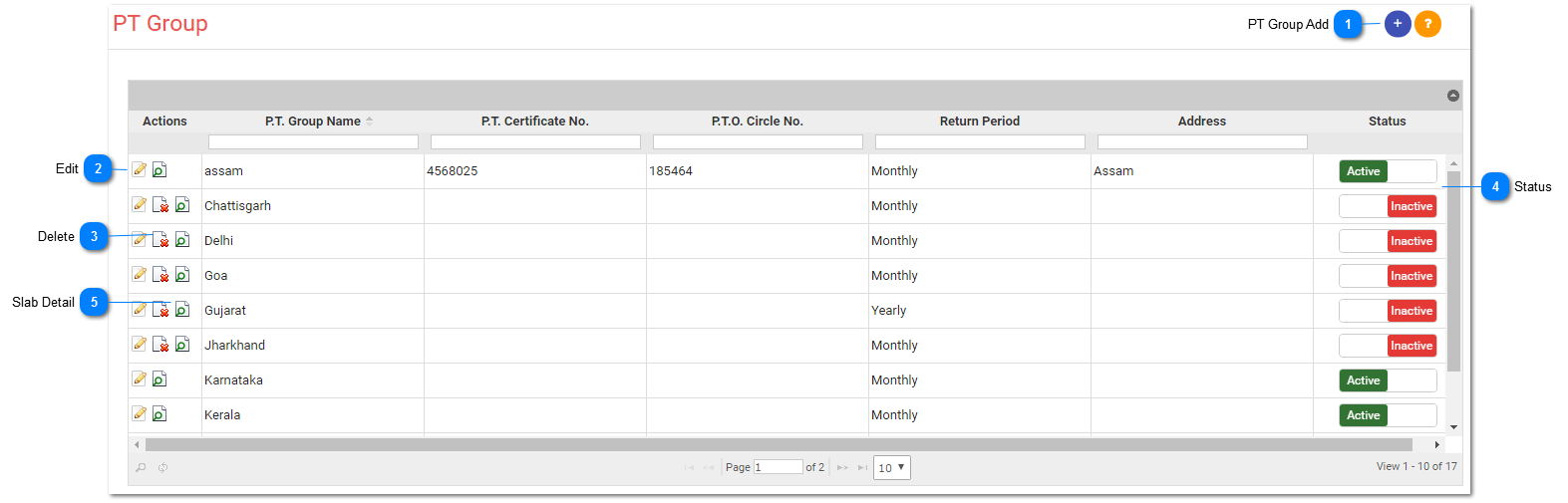

PT Group

PT Group is the Sub Module of the Payroll Settings Module.

This Module gives information about Professional Tax Group to the User.

In this Group User can see the Detail Information about Professional Tax Group.

In PT Group Grid If User want to Add Update or Delete PT Slab Detail Then Click on Slab Detail.

*Business Rule:-

1)PT Group is a master of PT Group Name.

2)You can select return period of tax such as..

-

Monthly

-

Half Yearly

-

Yearly3)You can add slab details from PT Group as well as PT Slab.

4)You can see this page in following modules..

-

Set Up> Payroll Settings> PT Group

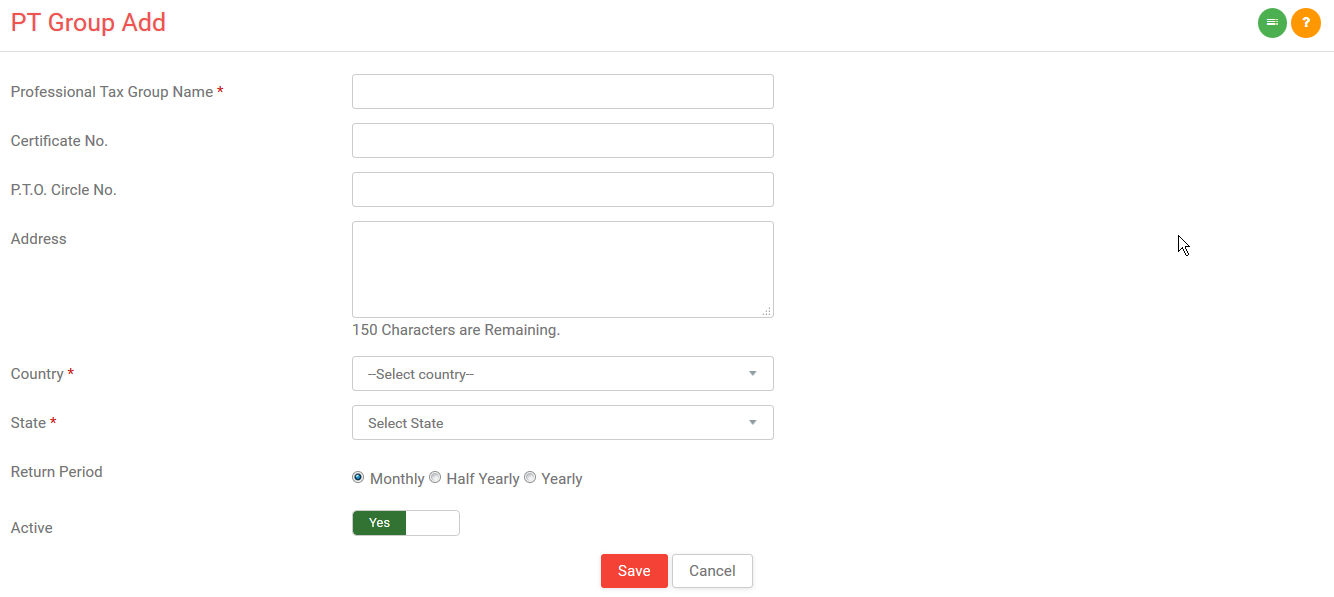

1)Professional Tax Group Name:

-

Enter PT Group Name.

-

Ex: Gujarat

2)Certificate No:

-

This field contains that this group is certified.

-

Enter certificate number.

3)P.T.O. Circle No.:

-

Enter PT Officer Circle No.

4)Address:

-

Enter Address of the PT Group with 150 characters.

5)Country:

-

Select Country of the PT group from the drop down menu.

6)State:

-

Select State of the PT group from the drop down menu.

7)Return Period:

-

In how many time period user have to return tax.1)Monthly2)Half Yearly3)Yearly

8)Active:

If you want to active it then switch it with yes otherwise no.

9)Save:

-

After entering all the information to save it press this button.

10)Cancel:

-

If you want to cancel it press this button.

11)List:

-

If you want to see list then press this button.

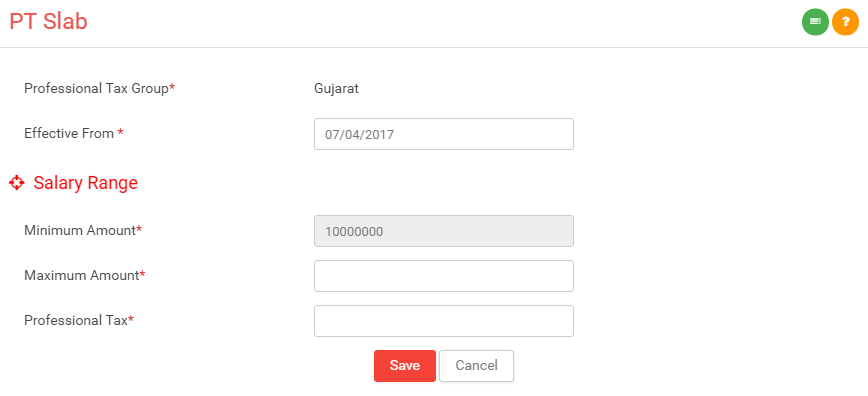

1)Professional Tax Group:

1)Professional Tax Group: -

This field contains Professional Tax.

-

It will automatically display.2)Effective From:

-

Enter date from which salary will be effected.**Salary Range:-1)Minimum Amount:

-

This field contains Minimum Amount for selected PT Group.2)Maximum Amount:

-

Enter Maximum Amount for selected PT Group.3)Professional Tax:

-

Personal tax in Salary of Employee for selected PT Group.