Form 24Q

Form 24Q:

*This form has to be filled up for declaration of a citizen’s TDS returns in detail.

*The form information is based on a citizen’s salary payments and the deductions made for tax.

*The declaration and payment is to be made quarterly by companies and firms in India.

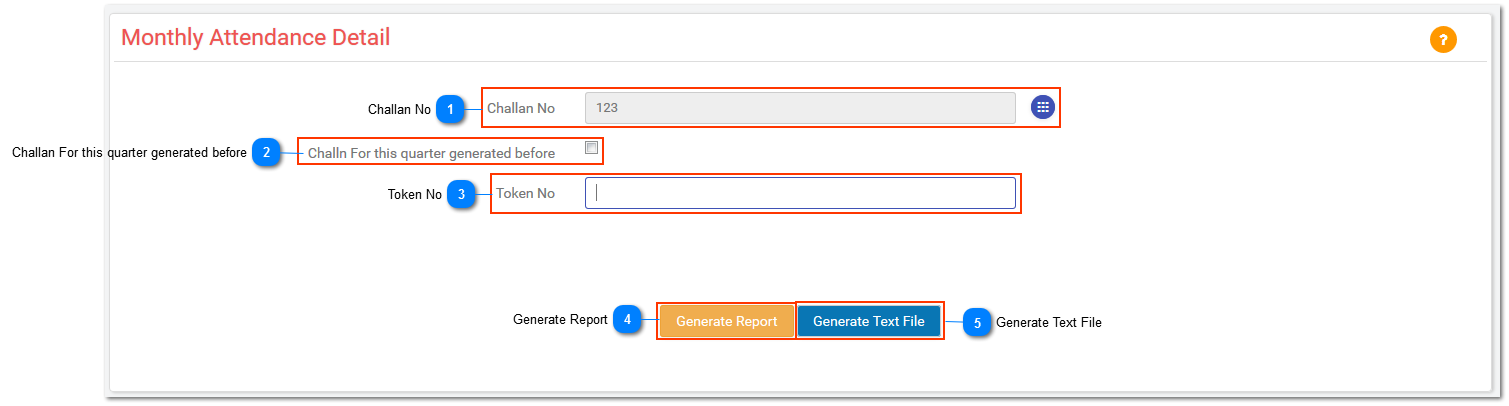

*Details such as Deductor, Deductees, Challans as well as Salary TDS have to be provided.

*The form can be downloaded and submitted online along with the required documents as well as submitted in person/company/organization.However, for certain people, it is compulsory to be submitted online.

*This includes:

If the deductor is a Government office

If the deductor is a company’s principal officer

If the deductor is required to have their accounts

audited for the prior year under 44AB of the Income Tax Act, 1961.

If there are 20 or more records of deductees in a statement for any quarter of a particular financial year.

*Annexure I and Annexure II are also forms that require submission along with this form. Annexure I has to be filled in for all four quarters of the year.

*Annexure II needs to be filed only for the final quarter of the year.