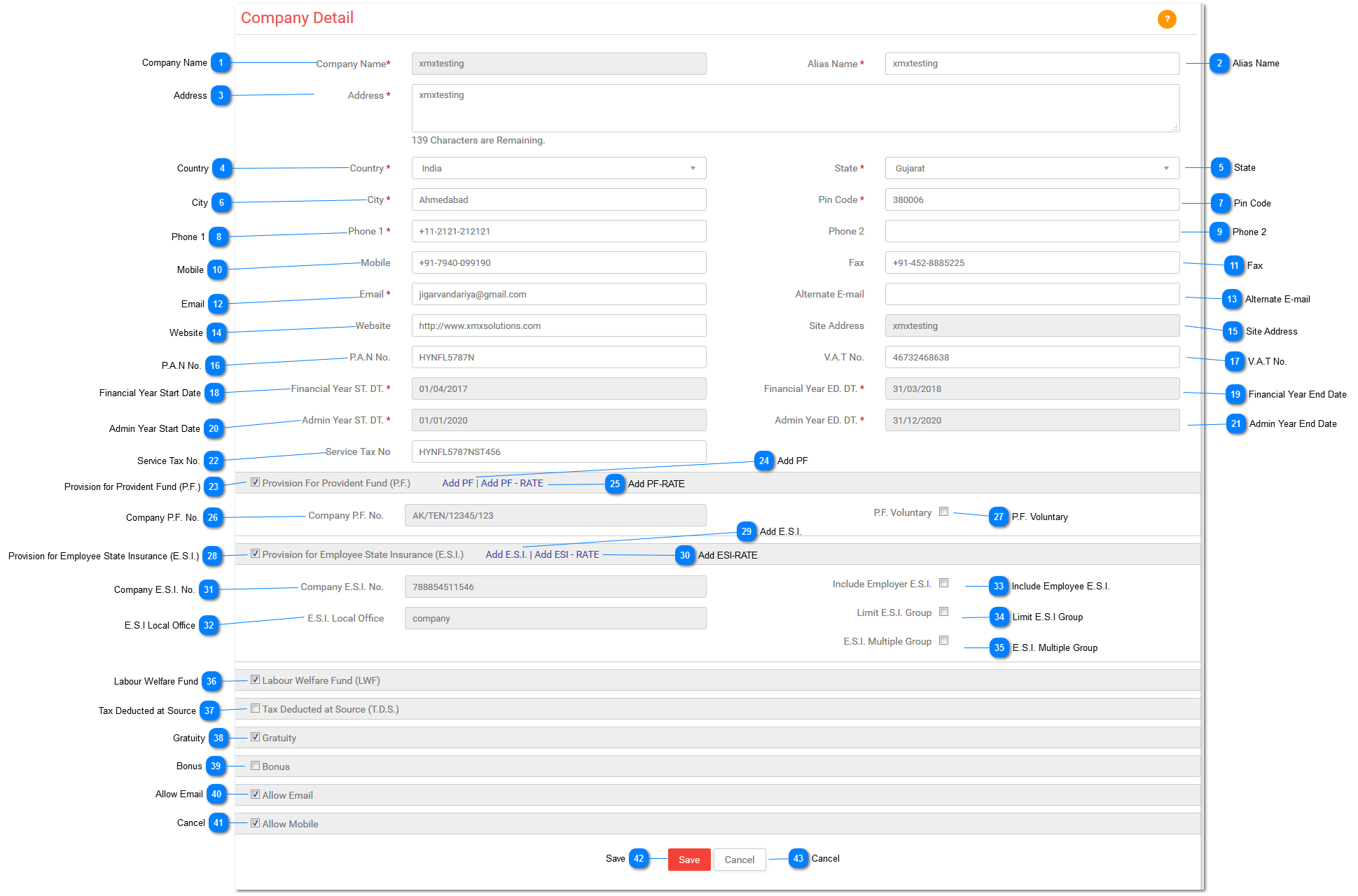

Company Details

The basic details of the company, such as Name of the company, Phone number of a company, Address of the head office contact details including government registration numbers and licenses such as PAN (Personal Account Number), PF (Provident Fund), VAT (Value Added Tax) Number, ESI (Employee State Insurance) Number, LWF (Labor Welfare Fund), TDS (Tax Deducted at Source) Numbers etc are to be updated by the company while registration in HR Mangtaa for the smooth function of all the functionalities of the application.

Admin can edit the information except 'Company Name' , 'Site address' , 'Financial Year ST DT' , 'Financial Year ED DT' , 'Admin Year ST DT' , 'Admin Year ED DT'.

*Business Rule:-

1)You will enter all fields in Getting Started module.

2)These all fields are fetched from the Getting Started page in Set Up page.

3)One time configuration for statutory compliances PF,ESI,PT.

4)After creation of a company, head office is display as a default branch.

5)You can edit head office information but you can't delete head office.

6)If branch is assigned then you can delete that branch.

7)Multiple PF Groups can't be assigned to one branch.

8)You can see this page in following modules....

-

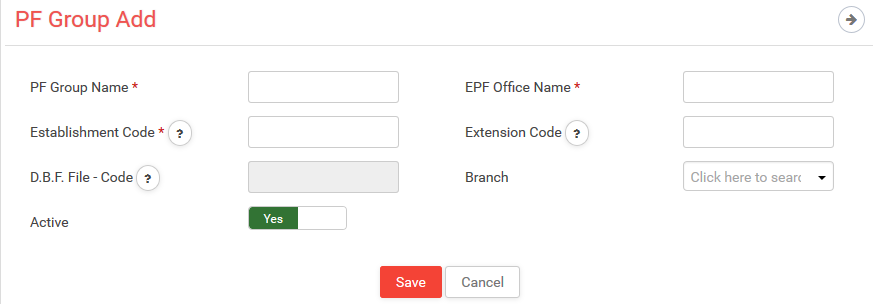

Getting Started> Company Settings> Company Details> Add PF

-

Set Up> Company Settings> Company Details> Add PF

-

Set Up> Payroll Settings> PF Group

1)Provident Fund Group Name:

-

Enter Provident Fund Group Name with 2 digits of State code.

-

Ex: For Gujarat: GJ

2)EPF office name:

-

Enter EPF office name with 3 digits using alphabets.

-

Ex: AHD

3)Establishment Code:

-

Enter Establishment code with 7 digits in numeric.

-

Ex: 1234567

4)Extension Code:

-

Enter Extension code with 3 digits in alphanumeric.

-

Ex: 000 or A1B or ABC.

5)D.B.F. File Code:

-

This field contains D.B.F. File code.

-

Ex: GJ/AHD/1234567/000

-

It is not editable.

6)Branch:

-

Select branch from the given drop down.

7)Active:

-

If you want to activate it then switch it with YES otherwise with NO.

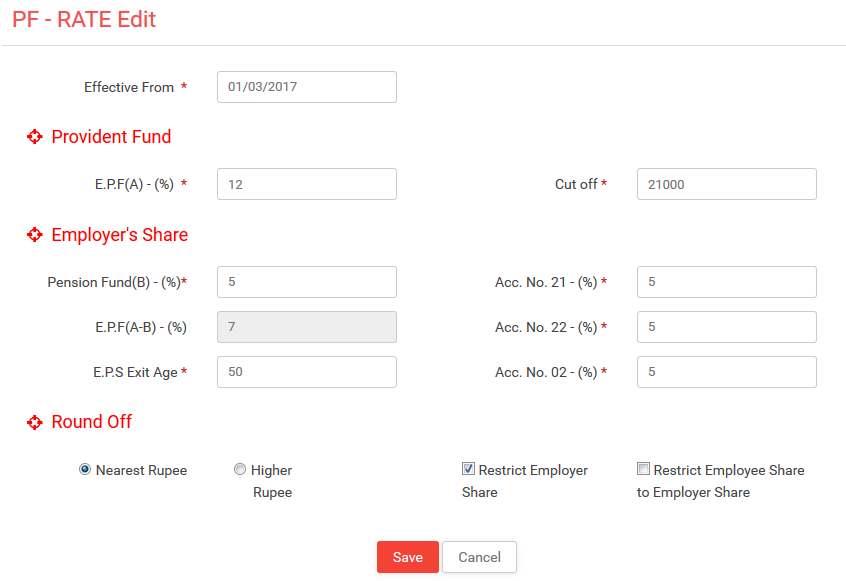

1)Effective From:

-

Select date from which this rate will be applicable.

-

It should not be less than the last date.**Provident Fund:1)EPF (A) - (%):

-

As per the Govt. rule it is 12%.2)Cut Off:

-

As per the Govt. rule it is 15,000.**Employer's Share:1)Pension Fund(B) - (%):

-

As per the Govt. rule it is 8.33%.2)EPF(A-B) - (%):

-

As per the Govt. rule it will be displayed with 3.67%.

-

EPF(A-B)%=EPF(A)% - Pension Fund (B)%.

-

It is not editable.3)Acc. No. 21 - (%):

-

As per the Govt. rule it is 0.5%.4)Acc. No. 22 - (%):

-

As per the Govt. rule it is 0.005%.5)Acc. No. 02 - (%):

-

As per the Govt. rule it is 0.85%.**Round Off:1)Nearest Rupee:

-

Select Nearest Ten Rupees to round off value to nearest ten rupees.For more information

-

Ex:If total income is :638944.50First paise would be ignored.Final total amount 638944 would be considered.This amount would be reduced /increased to the nearest multiple of 10.Now here last digit is 4 which is less than 5,it would be reduced to the nearestmultiple of 10 which would be 638940.2)Higher Rupee:

-

Select Higher Rupee to round off value to higher rupee.

-

Ex: If total income is :63.80Then Higher Rupee will be 64.3)Restrict Employer Share:

-

Select Restrict Employer Share to include it.4)Restrict Employee Share to Employer Share:

-

Select Restrict Employee Share to Employer Share to include it.

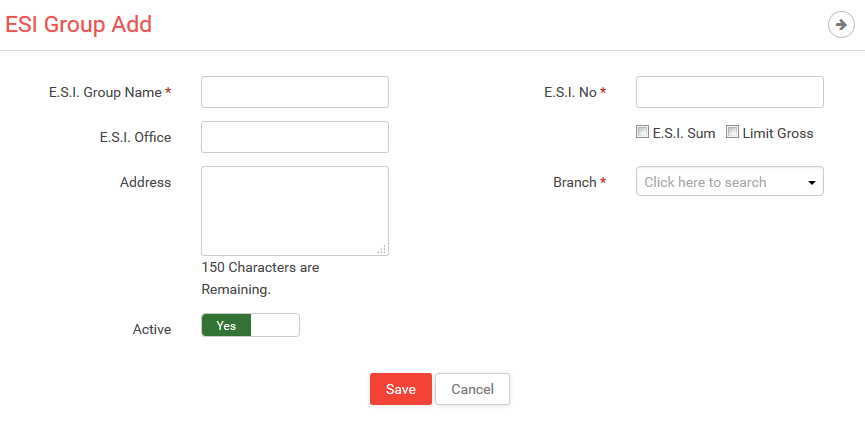

1)E.S.I. Group Name:

-

Enter the ESI group name.

-

Ex: Gujarat

2)E.S.I. No.:

-

Enter the ESI number with 17 digits associated with this group.

3)E.S.I. Office:

-

Enter the city name where the ESI for this group is located.

4)Address:

-

Enter the address related to this group with 150 characters.

5)E.S.I. Sum:

-

Click this checkbox if you want to add Employer ESI contribution.

6)Limit Gross:

-

Click this checkbox if you want to limit the gross salary of an employee.

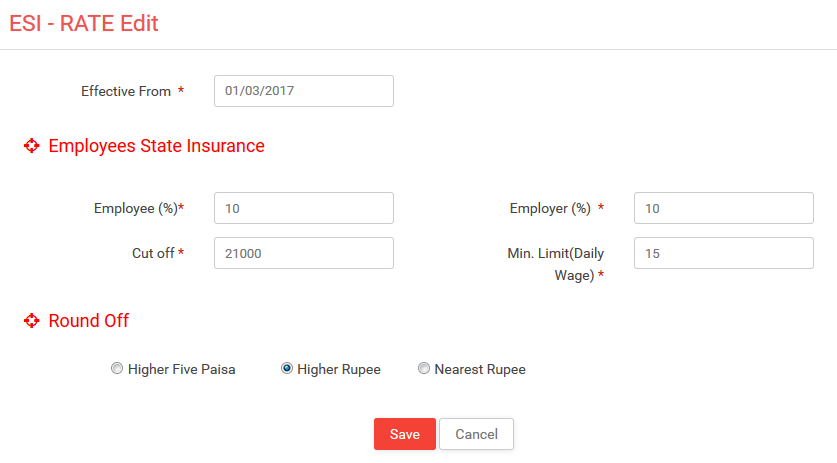

1)Effective From:

-

Select date from which this rate will be applicable.

**Employees State Insurance:

1)Employee (%):

-

As per the Govt. rule it is 1.75%.

2)Employer (%):

-

As per the Govt. rule it is 4.75%.

3)Cut Off:

-

As per the Govt. rule it is 15,000 till 31-12-2016.

-

As per the Govt. rule it is 21,000 from 1-1-2017.

4)Min. Limit (Daily Wage):

-

As per the Govt. rule it is 100.**Round Off:

5)Higher Five Paisa:

-

Select Higher Five Paisa to round off value to higher rupee. Higher Five Paisa Rs. 166.25 Rs.167.

6)Higher Rupee:

-

Select Higher Rupee to round off value to higher rupee. Higher Rupees Rs. 22.30 Rs.23.

7)Nearest Rupee:

-

Select Nearest Rupee to round off value to nearest rupee. Nearest Rupee Rs. 22.30 Rs. 22.